Business Challenges

- High Claim Denial Rates Due to Manual EOB Processing and Analysis Errors

- Time-Intensive Manual Claim Review Creating Payment Processing Delays

- Inconsistent EOB Interpretation Across Different Payers and Specialty Services

- Complex Specialty Billing Requirements Leading to Frequent Claim Rejections

- Limited Real-Time Claim Editing Capabilities Before Submission to Payers

- Resource-Heavy Appeals Process Consuming Significant RCM Staff Time

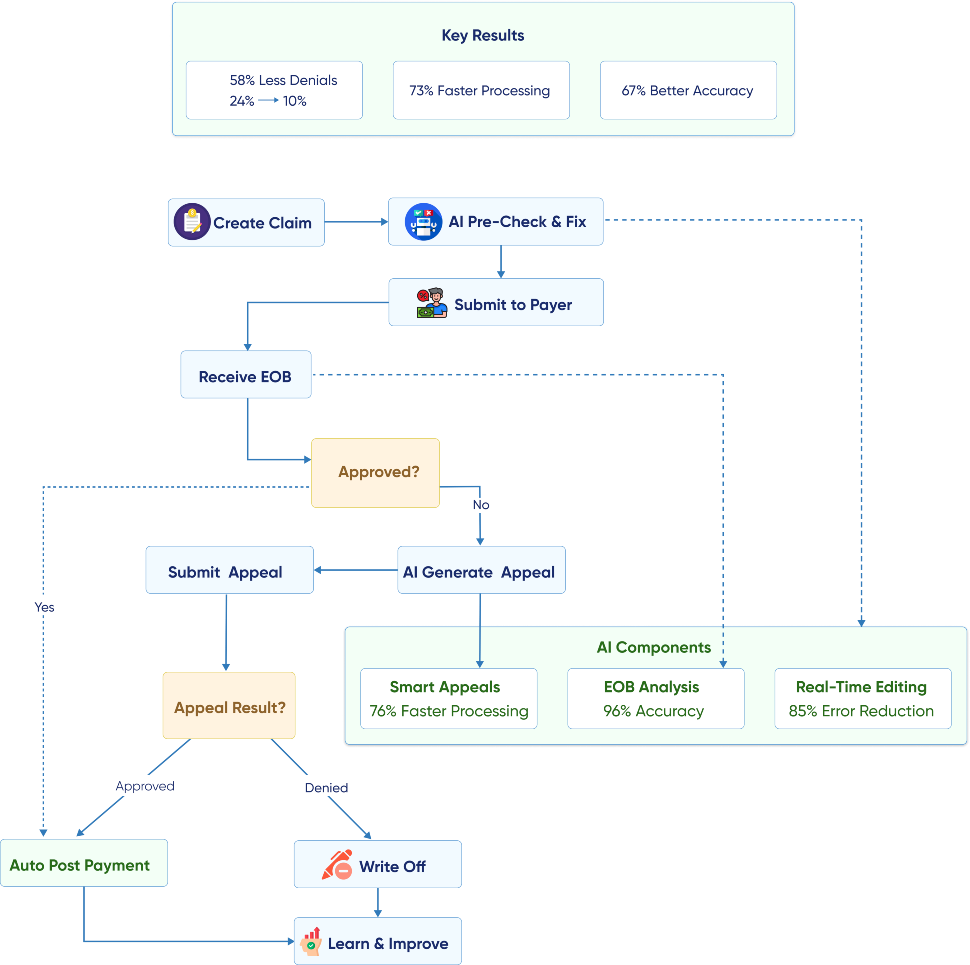

Solution

- AI-Powered EOB Analysis Engine: NLP processes explanation of benefits with 96% accuracy.

- Real-Time Claim Editing System: GenAI identifies and corrects issues before payer submission.

- Intelligent Payer Pattern Recognition: AI learns specific requirements across multiple insurance providers.

- Specialty-Specific Claim Optimization: GenAI adapts to complex billing requirements for different specialties.

- Automated Pre-Submission Validation: AI performs comprehensive claim checks, eliminating common rejection causes.

- Smart Appeals Generation Platform: GenAI creates compelling appeals documentation automatically.

Value Delivered

- 58% Reduction in Claim Denial Rates from 24% to 10% across all specialty services.

- 73% Faster EOB Processing Speed, reducing payment posting time significantly.

- 89% Improvement in Payer Pattern Recognition, enabling proactive claim optimization.

- 67% Better Specialty Billing Accuracy through AI-powered coding and documentation review.

- 85% Reduction in Pre-Submission Errors through Automated Validation Processes.

- 76% Decrease in Appeals Processing Time with automated documentation generation.

Solution Implementation

Our client, an extensive specialty network encompassing cardiology, orthopedics, neurology, and oncology practices with 150 providers across 12 locations, was experiencing significant revenue cycle challenges due to complex specialty billing requirements and high claim denial rates averaging 24% across their network. Their RCM team was spending over 60% of their time manually processing EOBs, identifying denial reasons, and preparing appeals documentation, creating substantial delays in payment posting and cash flow management. Each specialty had unique billing complexities and payer-specific requirements that made standardized claim processing difficult, while the high volume of claims (over 15,000 monthly) overwhelmed their manual review processes. The network needed an intelligent solution that could handle the complexity of specialty billing while reducing denials and accelerating payment processing across their diverse practice portfolio.

We implemented a comprehensive AI-powered health solution with a claims processing platform that combines advanced natural language processing for EOB analysis with generative AI capabilities for real-time claim editing and optimization. The system learns from historical denial patterns and payer behaviors to proactively prevent rejections, while streamlining the entire claims processing workflow from submission through payment posting.

AI-Powered EOB Analysis Engine

Our advanced NLP system processes explanation of benefits documents from hundreds of different payers, automatically extracting payment information, denial reasons, and adjustment details with exceptional accuracy. The AI engine understands complex EOB formats, terminology variations, and payer-specific reporting structures, converting unstructured EOB data into actionable insights for revenue cycle management. Machine learning algorithms continuously improve accuracy by learning from processed EOBs and feedback from RCM staff, while advanced pattern recognition identifies recurring denial reasons and payer behavior trends. The system processes EOBs in real-time upon receipt, automatically posting payments and flagging issues requiring human attention.

- Multi-Payer EOB Format Recognition: AI processes diverse EOB formats from hundreds of insurance providers with consistent accuracy.

- Intelligent Data Extraction: NLP converts unstructured EOB text into structured payment and denial information.

- Continuous Learning Integration: Machine learning improves processing accuracy through historical data analysis and staff feedback.

- Real-Time Processing Automation: The system automatically posts payments and identifies issues immediately upon EOB receipt.

Real-Time Claim Editing System

Our GenAI platform performs comprehensive claim analysis before submission, identifying potential issues and automatically implementing corrections to prevent denials and rejections. The system analyzes coding accuracy, documentation completeness, medical necessity requirements, and payer-specific guidelines to optimize claims for successful processing. Advanced algorithms compare current claims against historical denial patterns and successful submission data to predict approval probability and suggest improvements. The platform provides real-time feedback to billing staff with specific recommendations for claim optimization, while maintaining audit trails of all edits and modifications for compliance and quality assurance.

- Pre-Submission Claim Analysis: GenAI identifies potential issues and optimization opportunities before payer submission.

- Automatic Error Correction: The system implements coding and documentation corrections to prevent common denial causes.

- Predictive Approval Modeling: AI predicts claim approval probability and suggests specific improvements.

- Real-Time Billing Staff Feedback: The platform provides immediate recommendations with detailed explanations for suggested changes.

Intelligent Payer Pattern Recognition

The AI system maintains comprehensive databases of payer-specific requirements, denial patterns, and approval criteria across all insurance providers in the network. Machine learning algorithms analyze historical claim outcomes to identify subtle patterns in payer behavior, enabling proactive claim optimization tailored to specific insurance companies and plan types. The platform tracks changes in payer policies and requirements, automatically updating claim processing protocols to maintain optimal approval rates. Advanced analytics provide insights into payer performance, payment trends, and opportunities for contract negotiation or process improvement.

- Comprehensive Payer Database Management: AI maintains detailed profiles of requirements and patterns for all insurance providers.

- Historical Outcome Analysis: Machine learning identifies subtle payer behavior patterns for proactive claim optimization.

- Policy Change Detection: The system automatically updates processing protocols when payer requirements change.

- Strategic Payer Performance Analytics: Platform provides insights for contract negotiation and process improvement opportunities.

Specialty-Specific Claim Optimization

Our GenAI platform adapts to the unique billing requirements and complexities of different medical specialties, ensuring accurate claim preparation across cardiology, orthopedics, neurology, and oncology services. The system maintains specialty-specific coding guidelines, documentation requirements, and medical necessity criteria, automatically applying appropriate rules based on procedure codes and provider specialties. Advanced algorithms understand complex specialty billing scenarios such as bundled procedures, modifier requirements, and authorization protocols, optimizing claims for maximum reimbursement while ensuring compliance. The platform continuously learns from specialty-specific denial patterns to improve accuracy and reduce rejections across all practice areas.

- Multi-Specialty Rule Engine: GenAI applies appropriate billing guidelines based on provider specialty and procedure types.

- Complex Scenario Processing: The system automatically handles bundled procedures, modifiers, and authorization requirements.

- Specialty-Specific Learning: AI improves accuracy by analyzing the unique denial patterns of each medical specialty.

- Compliance Optimization: Platform ensures adherence to specialty-specific coding and documentation requirements.

Business Value

Improving UX

Helped being on the same page with the patients. We improved User experience and made the accuracy of the results higher.

Developing All Flow

Helped in having a competitive advantage. We chose a proper tech stack, developed all flow from A to Z and implemented in real life.

Optimization

Increasing operational speed by 2 times. Now all data in one place. Increasing operational speed by 2 times. Now all data in one place.

Transform Your Business with Powerful Insights Enabled by Cutting- Edge Generative AI